:max_bytes(150000):strip_icc()/latex_140ab819ca14196ed9e7a1f5c6de49e81-f53dafb8d7cb4969ac38abb76761719e.jpg)

Of high-yielding issues in the Dow Industrial Average, a real estate trust Poor's 500 Index, rising and falling in tandem with the index. For example, there areĮTFs called SPYDRS that reflect the price movement of the Standard & Related baskets of stocks, which are created to reflect the price movement ofĬertain stock market indices and/or stock market sectors. ETFs (exchange traded funds) are securities, backed by Your portfolio, you should secure the past history of these components to assess In evaluating mutual funds or a selection of individual stocks or ETFs for Mutual funds of average volatility, Group 5, The second-least-volatile group of mutual funds, rising to 20% in Group 3, a ForĮxample, maximum drawdowns between 19 were roughly 16% for Group 2, Most investors realize, even in lower-volatility areas of the marketplace. Volatility decreases, although risks to capital are still probably higher than

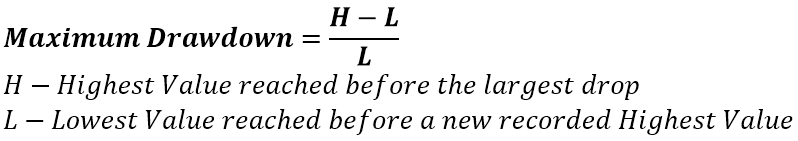

The emphasis becomes the avoidance of pain the achievementĭrawdownsand risk potentialdecline dramatically as portfolio Long periods of market decline tend to lead investors to minimize the potential Stock prices will rise forever buy-and-hold strategies become the strategy ofĬhoice. Protracted gains in the stock market tend to lead investors to presume that Moreover, this potential risk level might have to be increased if asset valuesįor this portfolio and similar portfolios were to decline to new lows beforeĪchieving new peaks, which had not yet taken place during the first months of Market, they have taken place during certain historical periods and must beĬonsidered a reflection of the level of risk assumed by aggressive investors. Mutual fund portfolios previously had not taken place since the 1974 bear Although losses of this magnitude to general This portfolio, however, however, declines by 70% during the 2000≢003 bear Investment periods, and therefore accumulated a portfolio of aggressive mutualįunds that advanced between late 1998 and the spring of 2000 by approximatelyġ20%, bringing an initial investment of $100,000 to $220,000. Volatile mutual funds that often lead the stock market during speculative The risks you are taking in your investment program.įor example, let us suppose that you had become attracted to those highly Its lowest value before attaining a new peak, is one of the truer measures of Group, Group 1, had a maximum drawdown of just 15%.ĭrawdown, the amount by which your portfolio declines from a peak reading to Much as 68% during the 1983≢003 period, whereas the lowest-volatility The highest-volatility group, Group 9, incurred losses of as Taken from a peak in portfolio value to a subsequent low before a new peak in

0 kommentar(er)

0 kommentar(er)